Dear Reader,

Thank you for backing my Substack as a dedicated weekly reader. Your presence is valued, and I express my gratitude to each and every one of you.

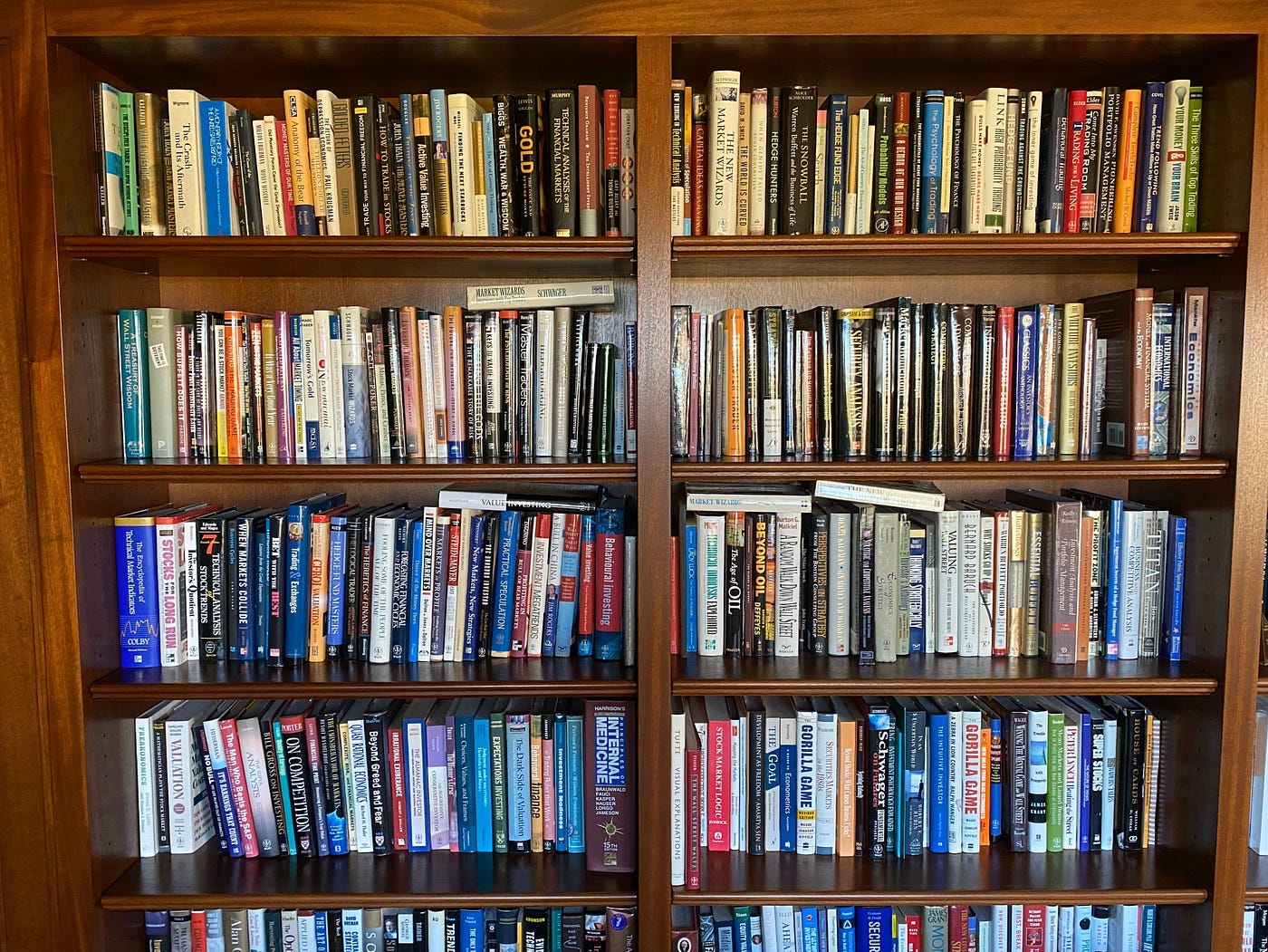

This week, instead of my usual newsletter, I am excited to share with you a curated list of transformative books that have profoundly influenced my perspective on finance, investing, and life in general.

These titles, authored by brilliant minds, offer invaluable insights and timeless wisdom.

Here are 20 must-read books in no particular order👇

1. "The Price of Tomorrow" by Jeff Booth: A thought-provoking exploration of the impact of technology on our economic future challenges and conventional perspectives. It forecasts a paradigm shift in how we perceive value and progress.

2. "Atomic Habits" by James Clear: A practical guide to transforming your life by focusing on the power of small habits, providing actionable insights to build positive routines and achieve lasting personal and professional growth.

3. "Rich Dad Poor Dad" by Robert T. Kiyosaki: A financial classic that contrasts two approaches to money—offering profound lessons on wealth-building, investment, and the mindset needed to attain financial success.

4. "Psychology of Money" by Morgan Housel: Delving into the psychological aspects of financial decision-making, this book explores the emotional and behavioral factors that shape our relationship with money, providing valuable insights for investors and savers alike.

5. "Investing for Growth" by Terry Smith: Terry Smith shares his investment philosophy, emphasizing the importance of investing in quality companies with long-term growth potential and providing practical advice for navigating the stock market.

6. "The Little Book That Beats the Market" by Joel Greenblatt: A concise guide to value investing, this book offers a straightforward formula for identifying undervalued stocks and achieving market-beating returns.

7. "The Almanack of Naval Ravikant" by Eric Jorgenson: A compilation of wisdom and insights from entrepreneur and philosopher Naval Ravikant, offering a guide to living a more meaningful and purposeful life.

8. "Quality Investing: Owning the Best Companies for the Long Term": This book explores the strategy of quality investing, advocating for long-term ownership of high-quality companies, and providing a comprehensive framework for evaluating investment opportunities.

9. "The Rational Optimist: How Prosperity Evolves" by Matt Ridley: Ridley presents a compelling argument for human progress, contending that innovation and exchange have been the driving forces behind the continuous improvement of human well-being throughout history.

10. "One Up on Wall Street" by Peter Lynch: Renowned investor Peter Lynch shares his investment philosophy, offering practical advice on how individual investors can leverage their unique advantages to achieve success in the stock market.

11. "The Making of a Value Investor" by Guy Spier: A memoir and investment guide, Spier shares his journey to becoming a value investor, drawing on insights from Warren Buffett and detailing the transformative impact of adopting a value-focused mindset.

12. "Capital Returns" by Edward Chancellor: This book delves into the world of capital allocation, exploring the strategies employed by successful investors and companies in deploying capital to generate returns and offering valuable lessons for investors.

13. "The Capitalist Manifesto: Why the Global Free Market Will Save the World": In this manifesto, authors declare the virtues of the free market, arguing for its ability to drive innovation, prosperity, and societal progress, challenging prevalent criticisms of capitalism.

14. "Poor Charlie’s Almanack: The Wit and Wisdom of Charles T. Munger": A comprehensive compilation of the wisdom and insights of Charlie Munger, Warren Buffett's long-time business partner, covering a wide range of subjects from investing to decision-making and life philosophy.

15. "Never Split the Difference" by Chris Voss: Drawing on his experience as an FBI negotiator, Voss shares negotiation techniques that can be applied in various contexts, providing practical advice for achieving successful outcomes in high-stakes situations.

16. "Skin in the Game" by Nassim Taleb: Taleb explores the concept of skin in the game, arguing that individuals and institutions should have a personal stake in the decisions they make, offering a critical perspective on risk and accountability.

17. "The Bitcoin Standard" by Saifedean Ammous: Ammous makes a case for the adoption of Bitcoin as a global standard for currency, discussing its properties, historical context, and potential impact on the future of money.

18. "Dhandho Investor" by Mohnish Pabrai: Pabrai outlines his value investing approach inspired by the Dhandho philosophy of business, emphasizing simplicity, focus, and the importance of investing in understandable, high-quality businesses.

19. "Same as It Ever Was" by Morgan Housel: Housel explores the timeless principles of investing, highlighting the consistency of human behavior in financial markets and providing insights into navigating the complexities of long-term wealth creation.

20. "The Alchemist" by Paulo Coelho: A philosophical novel, "The Alchemist" follows Santiago, a young shepherd, on a journey of self-discovery and pursuit of one's dreams, imparting profound lessons about destiny, purpose, and the transformative power of following one's heart.

If you have not read any of these books, I highly recommend you read them.

Make sure you follow me here and on X as well.

Thank you for reading.