Dear Reader,

Thank you for subscribing to my weekly newsletter. I am always trying to bring you the best content possible. I would appreciate it if you told your friends who might be interested in this type of content to spread the word.

Types of Investors

Here is a nice table for the different types of investors.

I am in the Quality Investor camp

I choose the best companies in the world

I do not put a lot of emphasis on dividend yield, p/e ratio, and other traditional metrics

I find for example: ROIC and capex/revenue metrics more useful for analyzing a company’s competitive advantage

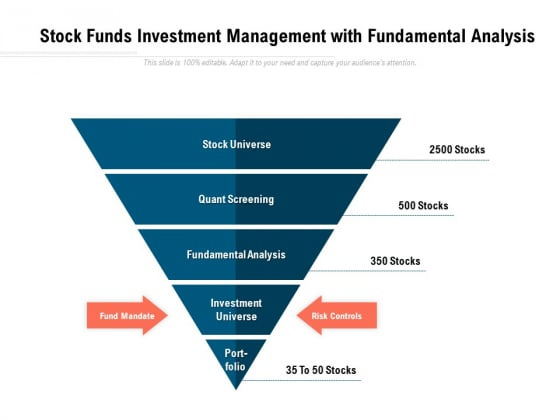

What is an investable universe?

It is a group of stocks you find attractive based on some criteria.

You make a list, and only companies on the list can be added to your portfolio

The purpose of this technique is to filter out the noise

It narrows down your focus to just less than 1% of companies

Here is a visual example:

How do you find them?

Look for companies with these qualities and compare them to the index average

healthier balance sheet

better capital allocation

higher cash conversion

higher growth rates

wider moat

After screening, it is important to examine each company manually and look for these:

Understand the business model

Get to know the management of the company

Value them with a DCF model to see their intrinsic value

But don’t spend too much time with valuation; just see if valuation makes sense or not

My investable universe

I am constantly trying to find the best quality stocks.

I use screening tools to find new companies that can be added to my investable universe list

You can read my #2 article for more about screeners

Here is a screener you can use, for example:

Revenue growth >7%

Cash conversion >90%

ROIC >15%

FCF/share growth >10%

Net Debt / Free Cash Flow <3

A disclaimer on my Investable universe

You may come across other stocks that exhibit monopolistic traits and possess exceptionally high quality. I am consistently engaged in research. If a company isn't included on the list, it doesn't necessarily imply that it shouldn't be there. I have limited time and resources at my disposal, so I employ screening methods to discover new stocks. Nevertheless, it's quite challenging to stay updated across all sectors, industries, and countries. I prefer to focus on my area of expertise and geographical comfort zone. I concentrate on companies I can comprehend to a certain extent. Consumer-oriented businesses are easier to fathom than B2B enterprises due to their inherent complexity. Some companies on my list are less familiar to me than others, but I'm actively working on in-depth research for them.

Here is the list of my Investable Universe (43 stocks)👇

I have divided them into 3 tiers based on their quality

(Bold is part of my portfolio and there is no particular order inside the tiers!)

Tier 3

Keep reading with a 7-day free trial

Subscribe to Analyzing Alpha Insights to keep reading this post and get 7 days of free access to the full post archives.