Hello everyone,

I am pleased to announce my return and commitment to delivering ongoing content. I appreciate your continued support throughout this journey.

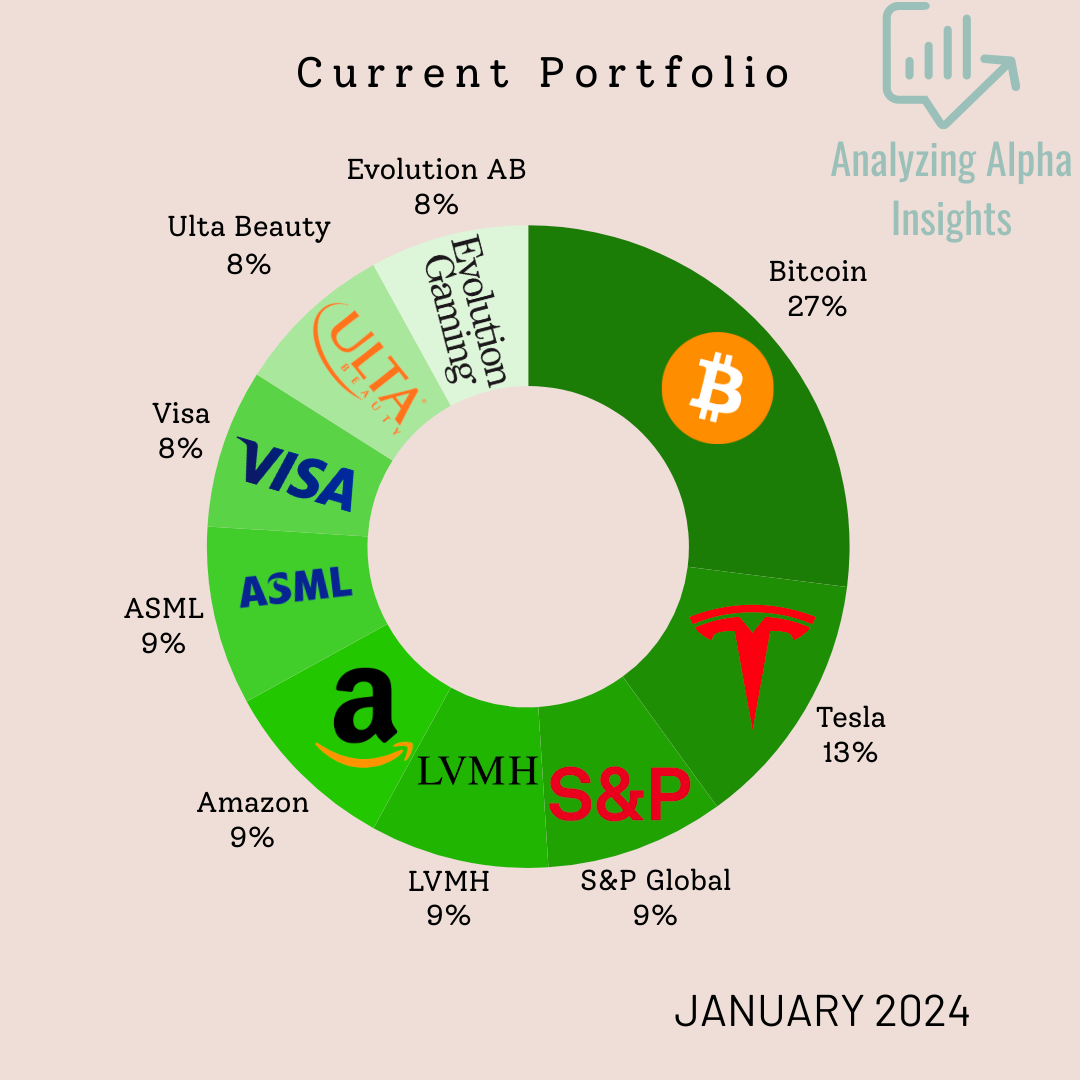

During the last two months, my portfolio has undergone some significant changes.

Here is an updated version:

I have made a new investment in LVMH on the Paris Stock Exchange at a price of €660.

Additionally, I have divested from Berkshire Hathaway at a price of $365.

Let’s dive into why I bought LVMH first.

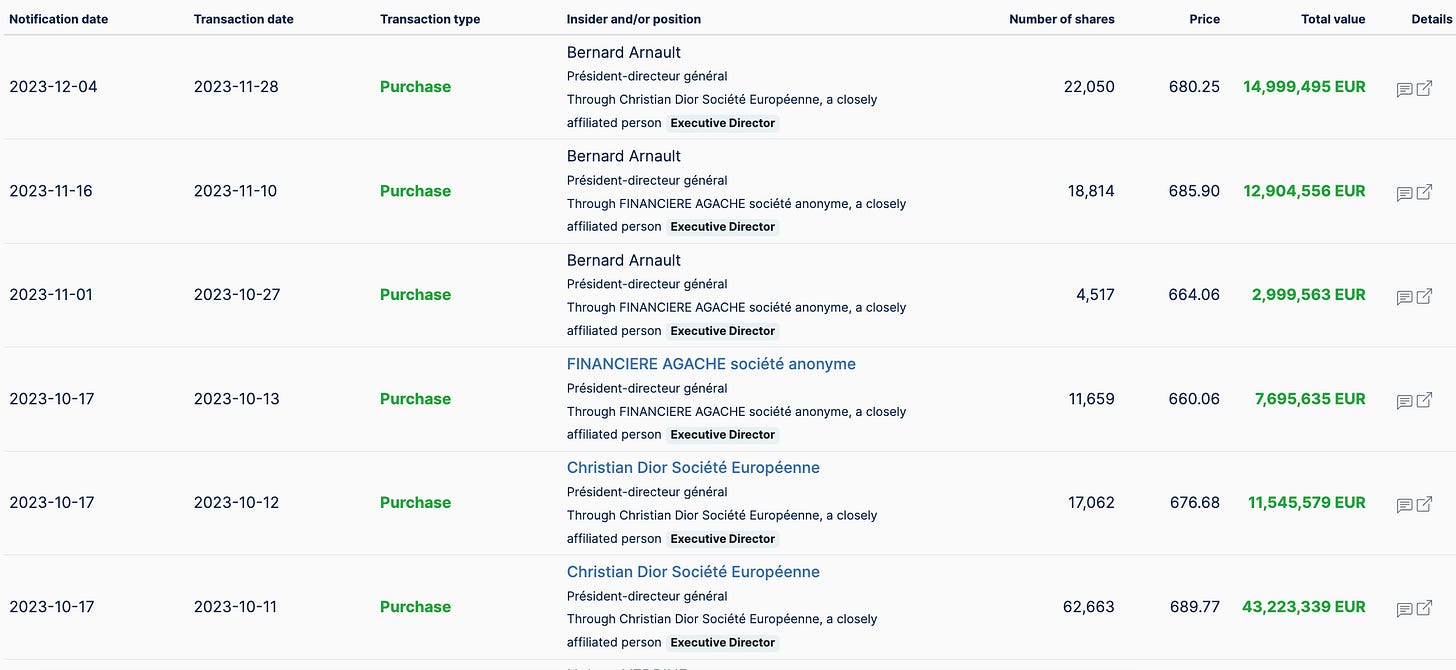

I recently invested in LVMH Moet Hennessy Louis Vuitton SE (LVMH) due to several compelling factors. LVMH has a strong gross margin, a key indicator of its profitability. The company's diverse brand portfolio includes well-known names in the luxury goods market, such as Louis Vuitton, Moet & Chandon, Hennessy, and Christian Dior, among others. This diverse portfolio provides a level of resilience and stability. Additionally, LVMH is a family business with a founder-led approach, which can contribute to a long-term strategic vision and stability. The company also has significant insider ownership, aligning the interests of management with those of the shareholders.

Bernard Arnault, the CEO of LVMH, has demonstrated a strong vote of confidence in the company by significantly increasing his stake. His recent purchase of shares, totaling 270 million euros, has further augmented the family's ownership of the luxury group. This move is very positive, as it reflects Arnault's commitment to strengthening his family's position within the company he leads. Furthermore, Arnault's aggressive approach to investing and his bold, ambitious style have been key factors in the significant growth of LVMH's stock price over the years.

Arnault's investment activities and the subsequent impact on LVMH's stock price are indicative of his strategic and long-term approach to wealth creation. His actions have not only influenced the company's stock performance but have also contributed to his personal net worth, which has seen substantial growth in recent years.

Here is their brand portfolio:

LVMH's stock has shown steady growth over the past decade, largely due to its presence in all five major sectors of the luxury market: wines and spirits; fashion and leather goods; perfumes and cosmetics; watches, jewelry, and selective retailing.

Here are some of the most important financial metrics for LVMH:

P/E Ratio (TTM): 20.4

Gross Margin (TTM): 68.72%

Price-to-Sales Ratio: 3.96

Enterprise Value to EBITDA Ratio: 12.98

5-Year Growth Rate: 16%

Dividend Yield: 1.9%

LVMH's forward price-to-earnings (P/E) ratio is approximately 20.4, which is in line with its historical average over the last 20 years. This suggests that the company may be trading at a fair price. However, considering the significant strengthening of the company's financial position and brand recognition over the past decade, some investors argue that LVMH is undervalued at its current P/E ratio. The company's acquisitive nature has enabled it to enhance its brand portfolio and is seen as a driver for compounding growth in the long term. Additionally, LVMH provides indirect exposure to Hermès, another renowned luxury goods company, further enhancing its investment appeal.

The company's key financial metrics, such as the price-to-sales ratio of 3.96 and the enterprise value-to-EBITDA ratio of 12.98, also indicate its fair market value.

In summary, LVMH's forward P/E ratio, along with its robust financial and brand position, acquisitive strategy, and indirect exposure to other high-quality companies, makes it an intriguing investment opportunity for those seeking exposure to the luxury goods sector.

I decided to sell my Berkshire Hathaway stock at the current price due to several reasons. Firstly, the company's elevated book value raised concerns about its potential for further growth. Additionally, Berkshire Hathaway's significant concentration in Apple stock, which has shown signs of stagnating growth and is not a major leader in the AI industry, added to my apprehensions. Furthermore, the company's substantial investments in the oil sector appeared questionable to me, given the increasing focus on renewable energy and the potential long-term impact on oil demand. Moreover, I observed a decrease in Warren Buffett's active involvement in the company's investment activities, which led me to question the firm's ability to outperform the S&P 500 with its current portfolio over the next decade.

The company's forward price-to-earnings (P/E) ratio was approximately 21.67, indicating a relatively high valuation. Despite Berkshire Hathaway's historical significance and Warren Buffett's iconic leadership, the aforementioned concerns led me to believe that the stock may not offer the level of growth and performance I seek in my investment portfolio.

In conclusion, the combination of the company's elevated book value, heavy reliance on Apple stock, substantial investments in the oil sector, and a perceived decrease in Warren Buffett's active involvement in investment decisions prompted me to sell my Berkshire Hathaway stock at its current price.

Thanks for reading.

Please share it with your friends who might like to read my substack as well.